#Manual vs Automated Accounts Payable: Which is the Best Option for Your Business?

When it comes to managing your business's finances, one of the most important tasks you'll need to handle is accounts payable. This refers to the process of paying your bills and suppliers on time, and it's a crucial part of keeping your business running smoothly. However, there are two main ways to handle accounts payable: manually or through automation. In this article, we'll take a closer look at the pros and cons of each option, so you can make an informed decision about which one is right for your business.

##Manual Accounts Payable: Pros and Cons

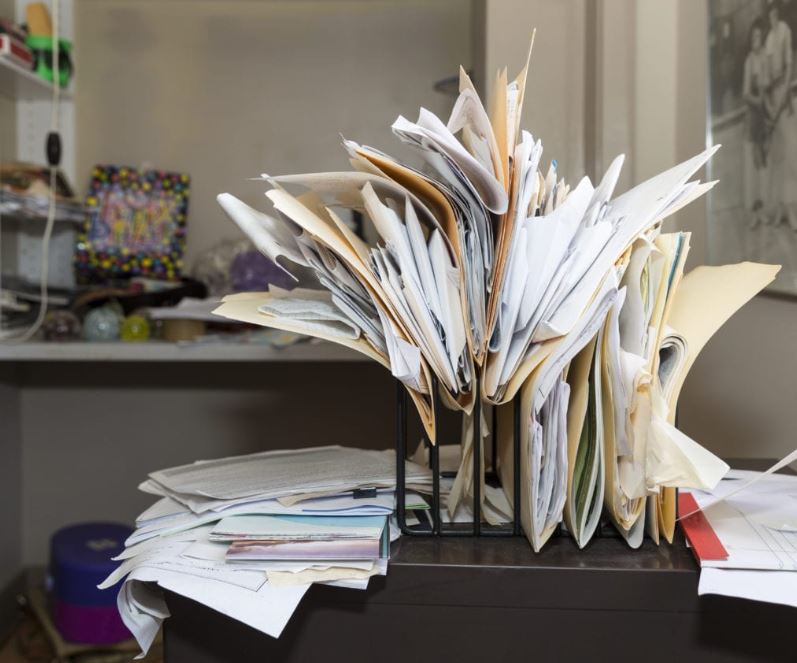

Manual accounts payable is the traditional method of handling bills and invoices. It typically involves manually entering each transaction into your accounting software, and then manually writing checks or making electronic payments to your suppliers. There are a few pros and cons to this method:

Pros:

- You have full control over the process, which can be beneficial if you're a small business owner who wants to keep a close eye on your finances.

- You can catch errors or discrepancies more easily, since you're manually reviewing each transaction.

Cons:

- It's time-consuming and labor-intensive, which can be a major drawback for busy business owners.

- It's prone to errors, since humans are fallible and mistakes can be made during data entry or payment processing.

##Automated Accounts Payable: Pros and Cons

Automated accounts payable, on the other hand, uses software to automate the process of paying bills and invoices. This can include using software to automatically match invoices with purchase orders, to automatically approve or reject invoices, and to automatically make payments. Here are the pros and cons of this method:

Pros:

- It's much more efficient than manual accounts payable, since the software does much of the work for you.

- It's less prone to errors, since the software is designed to catch mistakes and prevent fraud

Cons:

- It can be inexpensive to set up and maintain, especially if you're a small business with limited resources.

- You'll need to rely on the software to catch errors or discrepancies, which can be a risk if the software isn't configured correctly.

##Which Option is Right for Your Business?

Ultimately, the choice between manual and automated accounts payable will depend on your business's specific needs and resources. If you're a small business owner who wants to keep a close eye on your finances, inexpensive automated accounts payable may be the best option. However, if you're a larger business with more resources, expensive automated accounts payable may be the more efficient choice.

In conclusion, while both manual and automated accounts payable have their pros and cons, it's important to consider your business's specific needs and resources when deciding which method is right for you. Whether you choose manual or automated accounts payable, it's important to have an inexpensive option.

Introducing Easy Invoice Manager, the ultimate solution for simplifying your accounts payable process. With our user-friendly interface, managing invoices has never been easier. Say goodbye to cluttered paperwork and hello to streamlined, organized payments. Try us out today and see the difference for yourself. https://easyinvoicemanager.com